How to Maximize Revenue and Visits in Shopping Centers?Analytics based on Big Data allows mall operators to maximize revenues and visits by better selecting tenants, optimizing mall design, determining rents, establishing signage and advertising campaigns, etc.Monday, October 18, 2021

New technological tools allow mall operators to measure the number of consumers spending in and out of stores, the time they spend in and out of stores, know their relative wealth index and understand visitor behavior patterns, helping to determine the best mix of stores, site infrastructure, rent price range and implement more efficient signage and advertising.  "This image represents an analysis using location intelligence to identify the distribution of apparel stores within Lenox Square Mall in Atlanta." What benefits does mall analytics bring? Obtain the optimal mix of stores and categories Revealing typical walk routes within the mall and conversion patterns between categories, allowing you to identify the performance of each store by determining whether and by how much the presence of one brand increases or decreases sales in other stores. Answering questions such as:

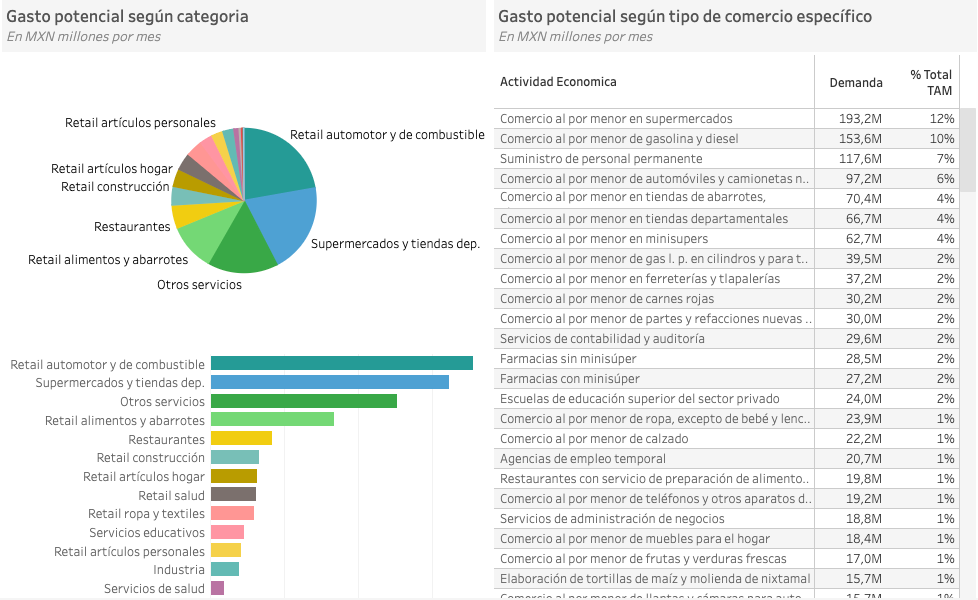

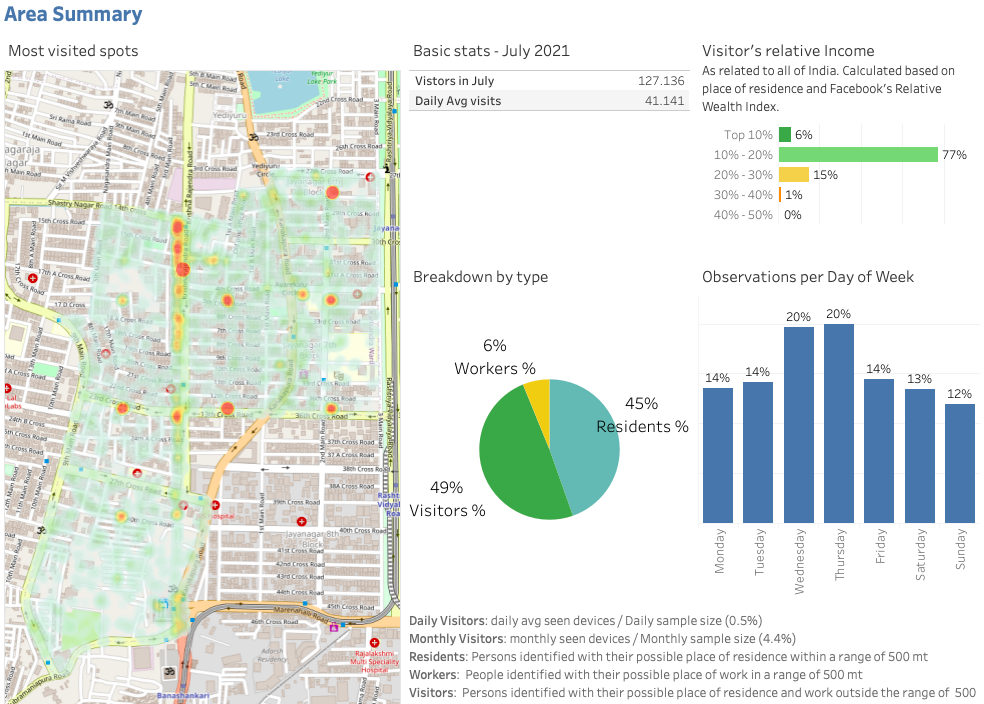

"This image represents a categorization of a point of interest and consumer preference according to different business turns." Matching tenants to locations Identifies the different obstacles in the sales conversion funnel, proximity rate, inbound and outbound traffic, number of conversions and reasons for failed conversions, maximizing sales and establishing lease fees depending on the location of the brand within the mall. You may be interested in: "Walmart Vs. Soriana: Consumer Foot traffic Analysis" Establish a price range for each lease Through a characterization of the points of sale, tenants and their consumers are classified, studying not only sales per unit, but also occupancy costs and profits, and thereby setting prices depending on the proximity of the unit to the entrance of the mall and the brand's price positioning.  "This image represents a study conducted by PREDIK Data-Driven on the mobility and characterization of the population at a point of interest." Tenant performance assessment Allows data to be collected from sensor devices to identify proximity conversation rate and traffic conversion rate on defined roadways based on tenant performance. Prioritization of billboards and digital signage Helps develop better strategies for revenue generation by identifying the most visited stores and mall locations, allowing you to plan strategies to advertise sponsored products through defined avenues where consumers are most likely to engage. Also read: "Location analytics can drive retailers to success: Case Study Home Depot Vs. Ace Hardware" Develop the mall infrastructure From information gathered from events, customer service points and social media surveys, it helps to identify the rate of footfall during different seasons to revolutionize the infrastructure and improve consumer interaction in the mall. Data-driven insights from mall analytics provide advantages at various levels of business operations and maximize revenue. The analytics performed by PREDIK Data-Driven provide a clear understanding to mall operators on how to increase revenue by converting the traditional mall into a hybrid mall. ¿Busca soluciones de inteligencia comercial para su empresa?Competitor analytics: Home Depot Vs. Lowe’s home improvementNovember 2021 Retailers are already implementing Big Data tools such as location intelligence and foot traffic analytics to understand consumer mobility patterns, measure foot traffic at each store, understand the performance of their outlets, and estimate competitor turnover. Footfall analytics: San Pablo vs. Guadalajara pharmaciesOctober 2021 Mobility analytics and location intelligence play an important role in business by helping to understand the behavioral patterns of consumers in any given zone of interest or point of sale. Footfall analytics: Costco Wholesale Vs. Sam's ClubOctober 2021 Big Data technological tools and spatial data play a very important role in business by measuring footfall and helping to understand consumer behavior patterns in any given area of interest or point of sale. Footfall Analytics in RetailSeptember 2021 Footfall analytics helps to make critical operational and strategic decisions for any type of business, improving conversion rates, maximizing sales, optimizing costs and increasing brand positioning.

×

ok |

|

×

![]()

español

español